MUMBAI: Markets regulator Sebi is investigating the four-and-half-hour trading disruption on MCX, the biggest commodities derivatives exchange in India, on October 28 that delayed the start of operations. If it finds faults with the exchange’s systems, MCX could face a monetary penalty.

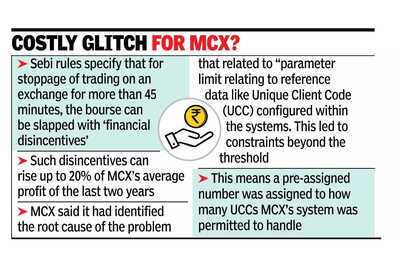

“Sebi has started an investigation into the same (trading halt on MCX),” a source said. Sebi rules specify that for stoppage of trading on an exchange for more than 45 minutes, the bourse can be slapped with ‘financial disincentives’, the new term for monetary penalty under regulator rules. Such financial disincentives could rise up to 20% of MCX’s average profit of the last two years.

An email sent to the regulator remained unanswered till late on Friday. As a matter of policy, Sebi doesn’t comment on ongoing investigations relating to a regulated entity. MCX didn’t respond to TOI’s request for comment on the matter.

A report by Reuters earlier Friday said that the regulator was looking into the whole incident of trading halt at MCX and was likely to penalise the exchange for the same. On Friday, MCX said in a release that it had identified the root cause of the problem that related to “parameter limit relating to reference data like Unique Client Code (UCC) configured within the systems. This led to constraints beyond the threshold.”

This means a pre-assigned number was assigned to how many UCCs MCX’s system was permitted to handle. And on the day of the tech glitch the number of UCCs that were sent to the bourse’s system were more than the pre-set limit. This in turn led to delay in the start of trading at 1.25pm against the normal start at 9am.

“We have taken steps to address the constraints to prevent similar issues in the future. Notably, trading systems have not had issues. Exchange systems are well positioned to support market volumes and growth,” the release from MCX said.

Sebi’s rules relating to trading halt due to tech glitch on an exchange or any other market infrastructure institution (MII), issued in July 2021, say that after such incidents the MMI should send in a preliminary report to the regulator within 24 hours and a root-cause analysis within 21 days.

Sebi rules also demand that if a trading halt extends for more than 45 minutes, the MII would face a financial disincentive of 10% of its average profit of the previous two years or Rs 2 crore, whichever is higher.

“Sebi has started an investigation into the same (trading halt on MCX),” a source said. Sebi rules specify that for stoppage of trading on an exchange for more than 45 minutes, the bourse can be slapped with ‘financial disincentives’, the new term for monetary penalty under regulator rules. Such financial disincentives could rise up to 20% of MCX’s average profit of the last two years.

An email sent to the regulator remained unanswered till late on Friday. As a matter of policy, Sebi doesn’t comment on ongoing investigations relating to a regulated entity. MCX didn’t respond to TOI’s request for comment on the matter.

A report by Reuters earlier Friday said that the regulator was looking into the whole incident of trading halt at MCX and was likely to penalise the exchange for the same. On Friday, MCX said in a release that it had identified the root cause of the problem that related to “parameter limit relating to reference data like Unique Client Code (UCC) configured within the systems. This led to constraints beyond the threshold.”

This means a pre-assigned number was assigned to how many UCCs MCX’s system was permitted to handle. And on the day of the tech glitch the number of UCCs that were sent to the bourse’s system were more than the pre-set limit. This in turn led to delay in the start of trading at 1.25pm against the normal start at 9am.

“We have taken steps to address the constraints to prevent similar issues in the future. Notably, trading systems have not had issues. Exchange systems are well positioned to support market volumes and growth,” the release from MCX said.

Sebi’s rules relating to trading halt due to tech glitch on an exchange or any other market infrastructure institution (MII), issued in July 2021, say that after such incidents the MMI should send in a preliminary report to the regulator within 24 hours and a root-cause analysis within 21 days.

Sebi rules also demand that if a trading halt extends for more than 45 minutes, the MII would face a financial disincentive of 10% of its average profit of the previous two years or Rs 2 crore, whichever is higher.

You may also like

Russia-Ukraine war: What is the 9M729? Missile that led Trump to quit key nuclear treaty with Moscow in 2019

Dev Diwali 2025: Wear yellow clothes on Dev Diwali, worship in this way, and you will receive the blessings of Lord Vishnu...

Only Fools and Horses creator's forgotten sitcom was pulled despite 15 million viewers

When science defied Hitler and Stalin

Protect plants and flowers from this year's first frost by adding 1 item to the soil now